... I'm huntin' houses.

My recent emancipation from credit card debt has emboldened me to take some tentative steps into that lion's den of real estate, the Bay Area housing market. Without really meaning to, I'd find myself cruising around choice neighborhoods Sundays, 2-4pm looking for that cheery-yet-elegant 'Open House' sign and then making the (often abrupt) maneuvers to intercept.

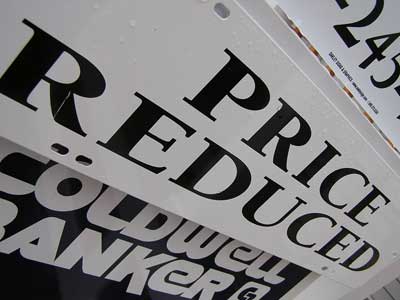

By choice neighborhoods, I mean the edges of what I *think* I can afford. If trends hold up, that should be expanding in the next few months. Before my eyes, prices have dropped $10-20k on locations I've been looking at the last two weeks alone. I'm actually fighting a strong impulse I have right now to move on this condo by Berkeley's dog park. Besides the overall cool-down in the market, there's the seasonal winter cool-down a-comin' that I'm hoping will give me a fighting chance at something better when autumn rolls around.

Berkeley's at the top of the list. The town and I have history, and I'd like to build on that. I'd be perfectly snug as a bug in parts of Oak-town or E'ville, though, if circumstances dictate. The Watergate condos that so many of my cohorts have bought up, for example, are well within the price range. I find them a bit bleak (I like to call them 'people storage'), but I'd hardly be suffering there.

BART proximity's also a huge factor. Living in the East Bay means commuting, and so help me I will not be able to maintain sanity if I have to endure the Bay Bridge 5x a week.

Money-wise, all the on-line calculators and trackers have given me a pretty good idea of what I can afford. All these cheats like Interest-only and TIC just aren't options, as far as I'm concerned. I really wanna go for the real deal or bust. Some people swear by TIC, but even in the best case it sounds like a hell of a long-term gamble.

The big variable for me is the job. It's a volatile industry and I really need to factor that in somehow with my decision. What if I have to move in a few months? Who knows, I may find myself making lattes or something for a bit. Or I may find myself... living in a shotgun shack. Or I may find myself... in another part of the world. Or I may find myself... behind the wheel of a large automobile... Anyway, if any of this happens, I need to figure out stuff about moving and renting it out or potentially selling it before the 2-year minimum.

I suppose it's also possible that home ownership may simply not be in the cards for me right now. I haven't seriously talked to a professional just yet, and there's only so much all these web tools can consider.

2 comments:

Web tools are about right, it's just number crunching really. A mortgage broker will look at your income and assets and come up with something THEY feel comfortable for you to afford, but that may or may not be the same as how you feel. Friends at work have gone through online mortgage places and had a pretty easy time.

Yeah, the tools seem really thorough, and they generally jibe with what I think I can manage.

Post a Comment